As a car accident lawyer in Federal Way, WA knows, any type of car accident can cause you to become injured. Even a minor fender bender could result in whiplash or broken bones.

How Park Chenaur Law Firm Can Help You

As soon as you contact us, we can get to work on your case. We’ll gather police and any investigative reports about your accident, your medical records about your injuries, physician’s statements and any witness statements we can collect. Armed with these and our extensive experience with car accident personal injury cases, we can fight for the highest possible settlement. With compensation, you can help pay for:

- Medical expenses

- Rehabilitation fees

- Time lost from work

- Any future impacts or limitations from your injuries

With Park Chenaur taking care of legal matters for you, it’s easier for you to recover and focus on your health. We will work hard to protect your legal rights and see you are properly compensated for your damages. Our attorneys pride ourselves on honesty, commitment to our clients, and assuring you get a fair settlement. Park Chenaur’s attorneys and staff will work hard on your case to settle it quickly and efficiently.

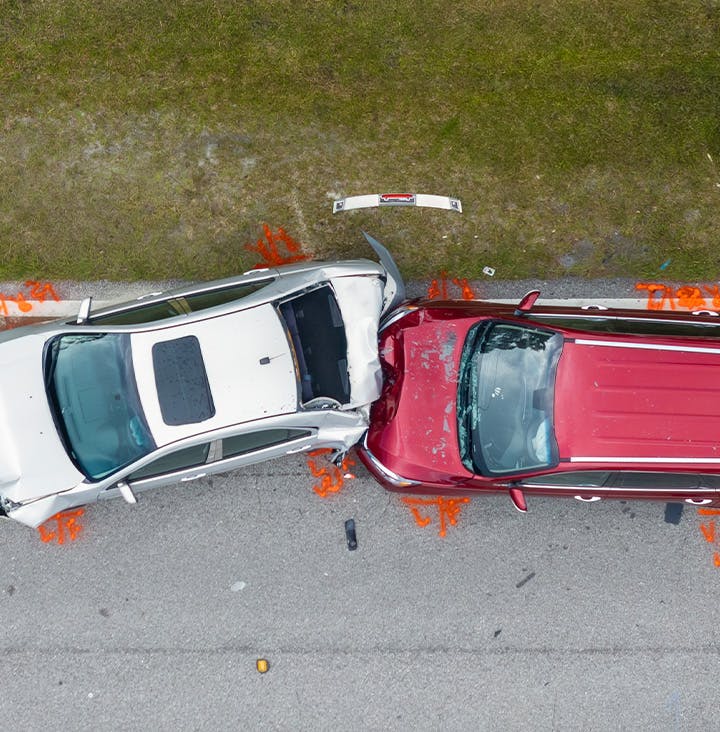

Head On Collisions

Head-on collisions almost always result in serious injuries due to the combined impact of two vehicles traveling in opposite directions.

Rear End Accidents

At Park Chenaur Injury Lawyers, we are driven to achieve justice and full compensation for injured people and their families.

Rideshare Accidents

Ridesharing applications like Uber and Lyft have exponentially increased in popularity due to their recency. There are now an unprecedented amount of drivers and riders using these carpooling apps.

Drunk Driving Accidents

According to the Centers for Disease Control and Prevention, approximately 28 people die every day in motor vehicle accidents that involve a driver under the influence of alcohol.

Whiplash Injuries

Even relatively minor accidents can end up causing debilitating injuries and seriously impacting victims’ lives.